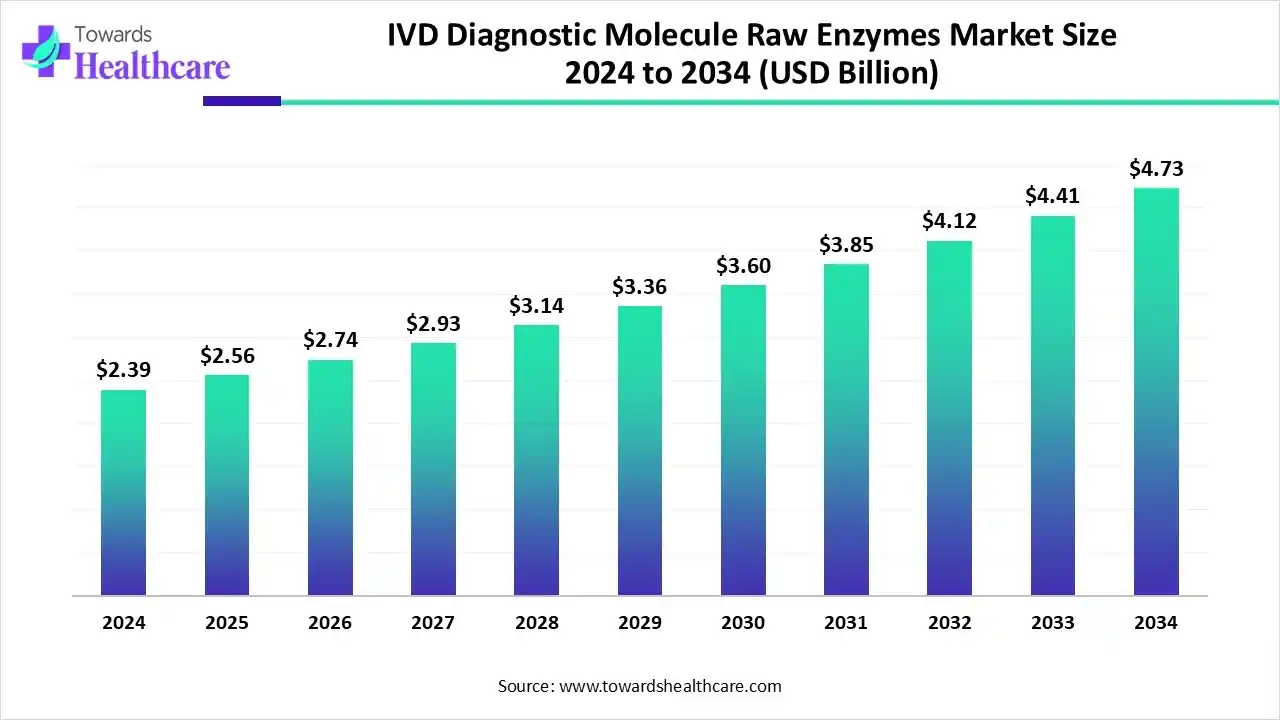

IVD Diagnostic Molecule Raw Enzymes Market Forecast to Grow at 7.13% CAGR by 2034

The global IVD diagnostic molecule raw enzymes market size was valued at USD 2.39 billion in 2024 and is predicted to hit around USD 4.73 billion by 2034, rising at a 7.13% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 15, 2025 (GLOBE NEWSWIRE) -- The global IVD diagnostic molecule raw enzymes market size is calculated at USD 2.56 billion in 2025 and is expected to reach around USD 4.73 billion by 2034, growing at a CAGR of 7.13% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6360

Key Takeaways

- The IVD diagnostic molecule raw enzymes sector pushed the market to USD 2.39 billion by 2024.

- Long-term projections show a USD 4.73 billion valuation by 2034.

- Growth is expected at a steady CAGR of 7.13% in between 2025 to 2034.

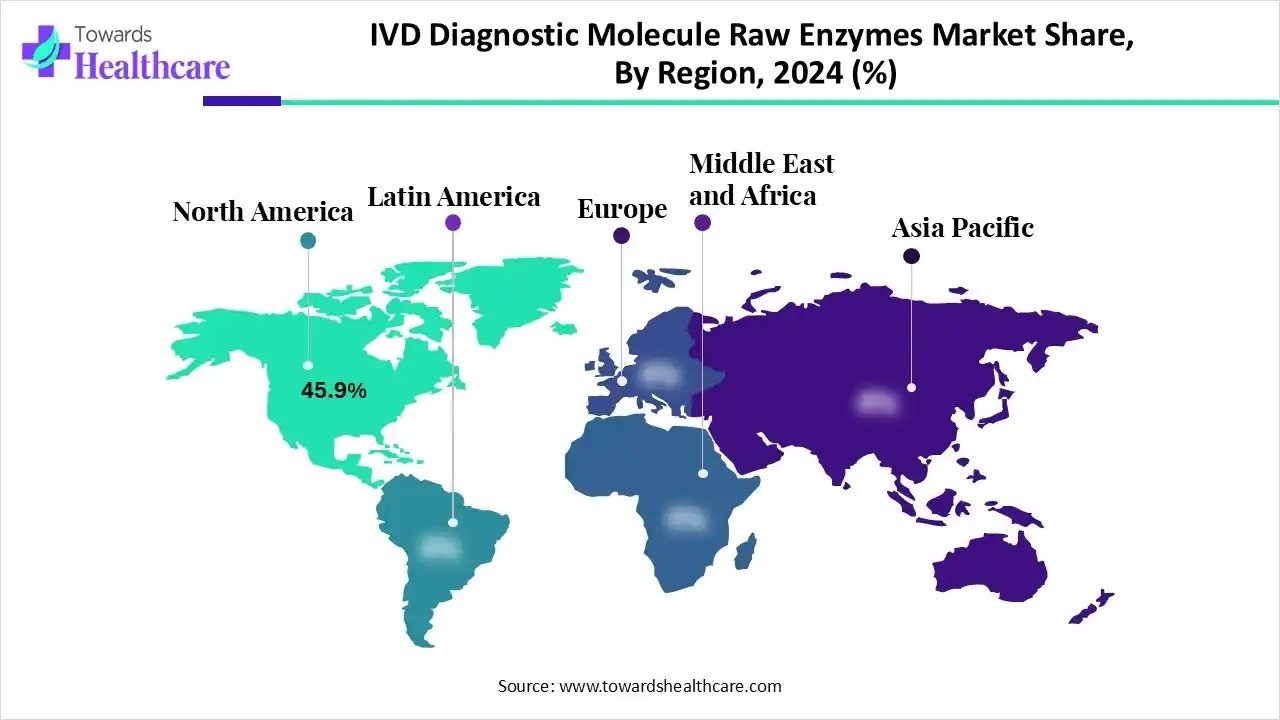

- North America was dominant in the market share by 45.9% in 2024.

- Asia Pacific is expected to grow rapidly in the studied years.

- By enzyme type, the polymerase & transcriptase segment led the IVD diagnostic molecule raw enzymes market in 2024.

- By enzyme type, the proteases segment is expected to grow at a rapid CAGR during 2025-2034.

- By application type, the infectious diseases segment dominated the market in 2024.

- By application type, the oncology segment is expected to witness the fastest growth in the coming years.

- By technology type, the polymerase chain reaction (PCR) segment registered dominance in the market in 2024.

- By technology type, the enzyme-linked immunosorbent assay (ELISA) segment is expected to grow rapidly in the upcoming years.

- By end user, the hospitals & diagnostic laboratories segment accounted for a major revenue share of the market in 2024.

- By end user, the biotech & pharmaceutical companies segment is expected to register rapid expansion during 2025-2034.

What are the Emerging Novelty in the IVD Diagnostic Molecule Raw Enzymes?

Firstly, the global IVD diagnostic molecule raw enzymes market covers purified biological catalysts, such as HRP, AP, polymerases, that are employed as major components in diagnostic kits, especially in PCR, ELISA. The overall progression is mainly fueled by the increasing chronic/infectious diseases, ageing populations, tailored medicine demand, and tech advances (PCR, NGS). Inclusion of recent developments is putting efforts to unveil novel or improved versions, particularly an innovative RNA polymerase, like CleanScribe RNA Polymerase, introduced in September 2024 by Alphazyme and TriLink BioTechnologies, for lowering double-stranded RNA during mRNA synthesis, crucial for both therapeutics and diagnostics.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Substantial Drivers Involved in the Market Growth?

A prominent catalyst is the expanding molecular diagnostics (PCR, NGS, CRISPR), which requires specialized enzymes (polymerases, ligases, reverse transcriptases) for precise genetic analysis and precision medicine. Furthermore, a rise in miniaturisation and boosted effectiveness further fuels the wider adoption of PoC devices, which necessitates stable, high-performance raw materials. Besides this, many firms are actively investing in bio-purification technologies for better sensitivity.

What are the Key Trends in the IVD Diagnostic Molecule Raw Enzymes Market?

- In October 2025, Biodesix entered into a partnership with Bio-Rad for the progression of advanced cancer diagnostics using ddPCR technology.

- In September 2025, Promega and Watchmaker Genomics partnered to transform molecular analysis with next-generation reverse transcriptase.

- In June 2025, Foresight Diagnostics and QIAGEN partnered to foster the development of companion diagnostic kits for lymphoma.

What is the Major Limitation in the Market?

Particularly, the market players are facing high raw material spending (enzymes, antibodies), stricter regulations, complex manufacturing, supply chain issues, and competition. Certain digital diagnostics are creating cybersecurity risks, which impact sensitive patient data.

Regional Analysis

What Made North America Dominant in the Market in 2024?

With the largest share, North America dominated the IVD diagnostic molecule raw enzymes market by 45.9% in 2024. Due to the rising early detection requirements, technological innovation, geographical shifts, and strong infrastructure, the region is promoting the development of advanced diagnostic solutions. Whereas leading firms, such as Thermo Fisher, Merck, and developing biotech companies, are stepping towards innovations for precision, speed, and wider platform compatibility.

For instance,

- In September 2025, Altesa BioSciences, a clinical stage pharmaceutical company, partnered with bioMérieux to use the BIOFIRE SPOTFIRE respiratory solution as its core point-of-care diagnostics platform at U.S. sites for Altesa's upcoming Phase 2B clinical trial.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Why did the Asia Pacific Grow Notably in the Market in 2024?

In the coming era, the Asia Pacific will expand rapidly in the IVD diagnostic molecule raw enzymes market. Substantial drivers involved are the accelerating diseases, escalating healthcare expenditures, mainly in India, China, and tech adoption, like NGS, liquid biopsy. As well as new facilities, such as Sysmex in India, 2025 and approvals, including the Roche system in Japan/Aus, 2025, drive the ASAP market.

For instance,

- In June 2025, Gene Solutions and Shenzhen USK Bioscience joined forces to develop a next-generation sequencing laboratory in Southern China.

Companies Overview in the Market in 2025

| Company | Specific Offerings |

| New England Biolabs (NEB) |

Recently, it has introduced the latest NEBNext UltraExpress DNA and RNA library prep kits, having improved polymerases for rapid and more efficient sequencing workflows. |

| QIAGEN | A company expanded its partnership with GENCURIX and ID Solutions to establish more oncology assays on the QIAcuityDx platform. |

| Bio-Rad Laboratories | It launched advanced purification media, including Nuvia wPrime2A Resin, a mixed-mode chromatography resin for scalable biomolecule isolation. |

| Takara Bio | This specialises through custom OEM/CDMO services for high-performance polymerases, like Titanium Taq, PrimeStar, and reverse transcriptases. |

| Aldevron | This focuses on Alchemy cell-free DNA technology and the Codex HiCap RNA Polymerase. |

Segmental Insights

By Enzyme Type Analysis

Why did the Polymerase & Transcriptase Segment Lead the Market in 2024?

In 2024, the polymerase & transcriptase segment captured the biggest share of the IVD diagnostic molecule raw enzymes market. These enzymes possess higher sensitivity, specificity, and quicker turnaround time. Nowadays, companies are empowering these properties to allow advanced applications, including multiplex assays and digital PCR (dPCR). Moreover, leaders are widely using these enzymes for improvements in LAMP and Recombinase Polymerase Amplification (RPA), raising their robustness and applicability for low-resource settings.

Besides this, the proteases segment is anticipated to expand fastest. These enzymes have a key role in molecular diagnostics to digest heat-stable enzymes or other proteins during DNA/RNA extraction, further supporting the preparation of samples for further analysis without intermediate purification steps. Currently, the market is emphasising optimisation of proteases for advanced molecular biology techniques, like Next-Generation Sequencing (NGS) and in situ hybridization (ISH). Recent research studies have shown the diagnostic and therapeutic potential of protease inhibitors and specific protease activity-based probes (ABPs) in the determination of proteolytic profiles in various pathologies.

By application type analysis

Which Application Type Dominated the IVD Diagnostic Molecule Raw Enzymes Market in 2024?

The infectious diseases segment held a dominant revenue share of the market in 2024. Prominently, a rise in cases of COVID-19, TB, hepatitis, cancer, diabetes, and the broader use of PEC are demanding specific enzymes (Taq polymerase, reverse transcriptase) for the detection of and resistance genes. Contribution of SHERLOCK (Cas13) and DETECTR (Cas12) are using enzymes for highly sensitive, faster viral/bacterial RNA detection, to facilitate PCR-like accuracy but expedited, often integrating with POCTs.

On the other hand, the oncology segment is predicted to grow at a rapid CAGR. Increasing cancer instances are fostering the adoption of Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) for liquid biopsies, which highly demands these advanced enzymes. Although the market is leveraging developments in digital pathology & histology assays, such as horseradish peroxidase (HRP) and alkaline phosphatase (AP) are integral to enzyme-based staining techniques, further assist visualisation of cancer biomarkers in tissue samples.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By technology type analysis

How did the Polymerase Chain Reaction (PCR) Segment Lead the Market in 2024?

In 2024, the polymerase chain reaction (PCR) segment registered dominance in the IVD diagnostic molecule raw enzymes market. The leading firms are focusing on engineered polymerases with accelerated speed, fidelity, and thermostability, with the use of AI/ML for design, like single-enzyme RT-PCR. In December 2025, Roche received FDA clearance and a CLIA waiver for its faster POC test for diagnosing Bordetella infections, which delivers PCR-accurate results in just 15 minutes.

However, the enzyme-linked immunosorbent assay (ELISA) segment is predicted to witness the fastest expansion. The era is raising sensitivity & speed with next-gen enzymes, including HRP variants, and exploring nanomaterials, like quantum dots, gold, as well as integration of digital tech, such as single-molecule detection. Recently, Rockland Immunochemicals, Inc. introduced the AccuSignal Nuclease ELISA Kit to find particular endonucleases during the manufacturing of gene therapies and vaccines.

By end user analysis

What Made the Hospitals & Diagnostic Laboratories Segment Dominant in the Market in 2024?

The hospitals & diagnostic laboratories segment led with a major share of the IVD diagnostic molecule raw enzymes market in 2024. These kinds of enzymes have substantial use in the early diagnosis, mainly in liver, heart concerns, tailored treatment guidance, with tracking chronic issues, and robust screening in infectious diseases. These facilities are widely used oxidoreductases, including Glucose Oxidase, HRP, in colorimetric assays for glucose, cholesterol, and immunoassays (ELISA).

Moreover, the biotech & pharmaceutical companies segment will expand rapidly. Specifically, an immersive, high-purity, quality-controlled raw enzymes support in ensuring persistent batch-to-batch performance of diagnostic kits is important for reliable medical diagnoses and adherence to strict regulatory standards, like FDA, ISO 13485. In these companies, enzymes act as more effective biocatalysts in drug synthesis, operating under milder conditions, including minimal temperature, pH, and pressure, over traditional chemical approaches.

Recent Developments in the IVD Diagnostic Molecule Raw Enzymes Market

- In December 2025, Switzerland’s Roche Diagnostics unveiled its first quantitative polymerase chain reaction system developed in China.

- In October 2025, OHAUS launched eco-friendly IVD centrifuges using R290 refrigerant for diagnostic labs.

- In September 2025, Creative Diagnostics unveiled validated inorganic pyrophosphatase ELISA Kits for mRNA vaccine production quality control.

Browse More Insights of Towards Healthcare:

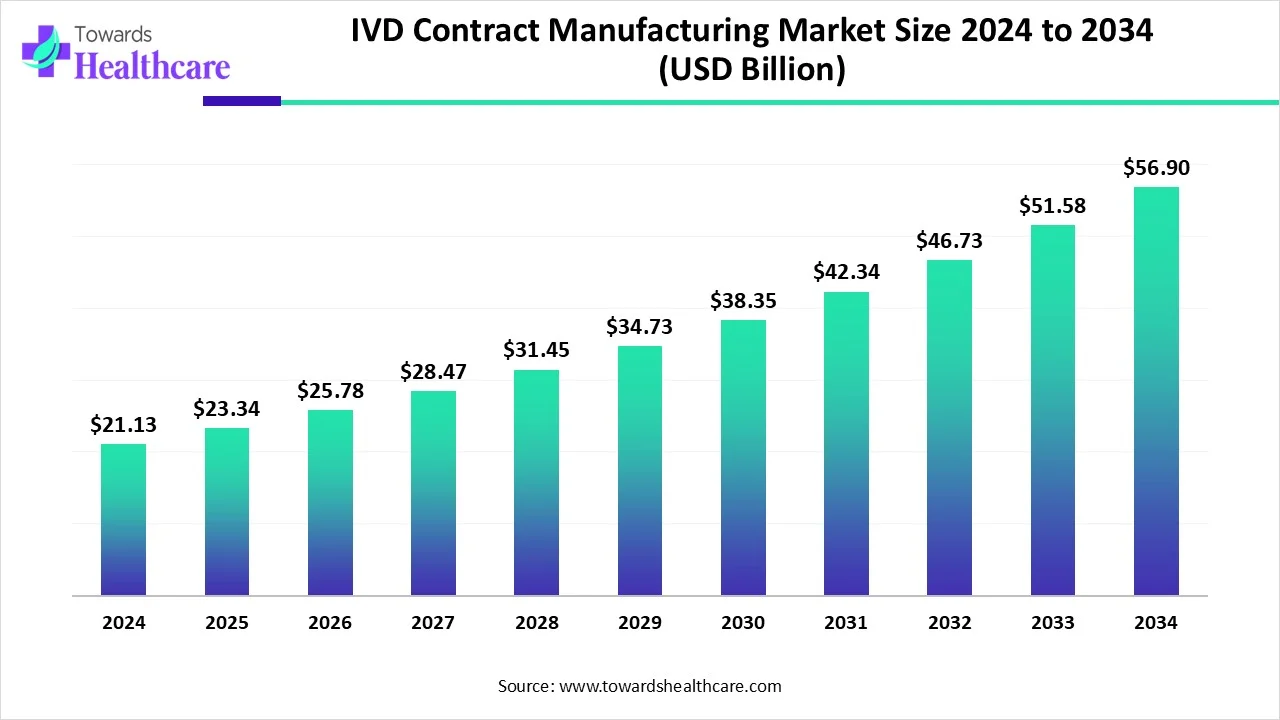

IVD Contract Manufacturing Market Size

The global IVD contract manufacturing market size is calculated at US$ 21.13 in 2024, grew to US$ 23.34 billion in 2025, and is projected to reach around US$ 56.9 billion by 2034. The market is expanding at a CAGR of 10.44% between 2025 and 2034.

Liquid Biopsy IVD Market Size, Growth, Trends and Key Players

The global liquid biopsy IVD market size was valued at US$ 2.21 billion in 2024 and is projected to grow to US$ 2.54 billion in 2025. Forecasts suggest it will reach approximately US$ 8.72 billion by 2034, registering a CAGR of 14.79% during the period.

Which are the Top Companies in the IVD Diagnostic Molecule Raw Enzymes Market?

- New England Biolabs (NEB)

- QIAGEN

- Bio-Rad Laboratories

- Takara Bio

- Aldevron

- Codexis

- Amano Enzyme Inc.

- Advanced Enzymes Technologies Ltd.

- Biocatalysts Ltd.

- Enzo Life Sciences

- MP Biomedicals

- BBI Solutions

- EKF Diagnostics

- Medix Biochemica

- Canvax Biotech

Segments Covered in the Report

By Enzyme Type

- Polymerase & Transcriptase

- Proteases

- Ribonuclease

- Others

By Application

- Infectious Diseases

- Oncology

- Cardiology

- Others

By Technology

- Polymerase Chain Reaction (PCR)

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Others

By End-User

- Hospitals & Diagnostic Laboratories

- Biotech & Pharmaceutical Companies

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6360

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.